BY MARGO BLACKSTONE

This is one of the biggest roadblocks for women looking to start our program, and I wanted to take some time to lay out the PayPal financing, or other credit card financing options if cash, lower interest loans, gifts, etc aren’t an option for you!

I’ll take you back in time for a moment to when I was trying to figure out how to pay for my midwifery school. I didn’t have any savings and I was a nanny making $10 an hour working very part time while apprenticing. I had a $5000 limit on my credit card which I luckily didn’t carry any debt on. When I nearly maxed my card out to pay for a distance learning midwifery program I had no idea how I would pay it off, but I knew that NOT studying midwifery wasn’t an option. I credit using YNAB (You Need a Budget) with helping me and my partner make ends meet on a super meager income. In the end, the money I spent on midwifery education and apprenticeship costs were the best I ever spent.

So back to PayPal financing (which you can use to pay for IBMS as long as you qualify) or other credit financing. I am not a proponent of racking up credit unless you have a plan for paying it back and knowing that the end goal is going to actually bring IN money. So first things first, either have a plan to pay it back (maybe your partner has a steady income and monthly payments won’t be an issue) or talk with enough successful midwives to know deeply that this IS a way to make money. I also wrote a post about Money, Midwifery and Abundance that you can check out here.

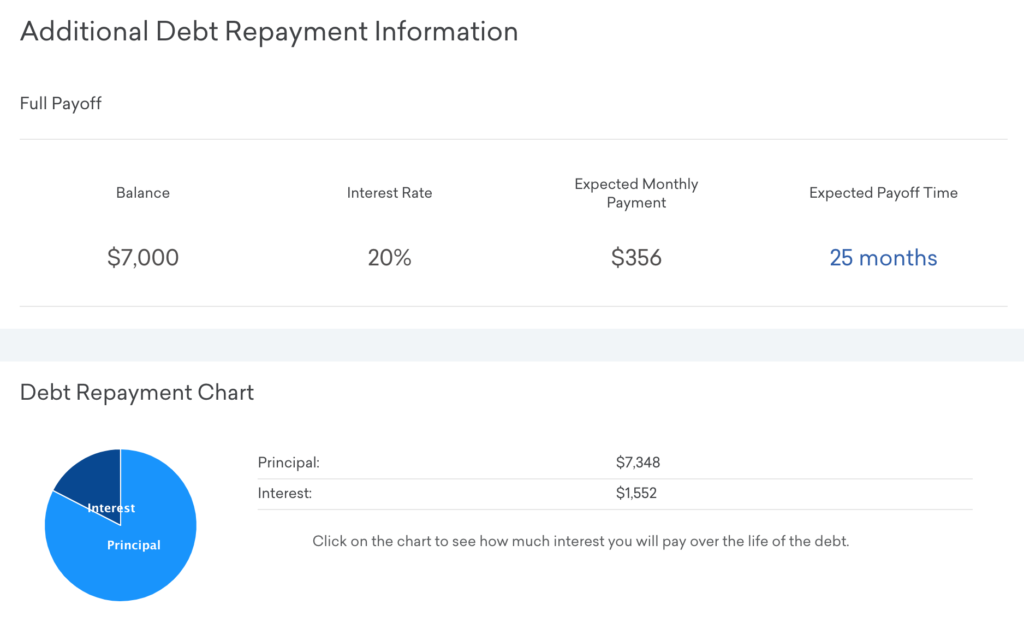

I’m including a screenshot here of what it would look like to use PayPal or a similar 20% interest credit card to pay for IBMS. If you were to choose to pay on the lower end of our “pay what you’re able” enrollment fee scale, you would finance $7000, and with $356 a month you’d pay off your tuition by the time you were done with the program. You would end up paying about $1500 in interest, for a total of $8500. Sometimes just knowing some of those numbers makes it feel less scary, and more doable. I used Credit Karma’s calculator and you can plug in different repayment lengths and see what your total cost will be depending on how you do it.

Another consideration if the finances are feeling insurmountable is that most communities could use more doulas and more childbirth educators. With the right support, you should be able to generate enough to 1) save up for midwifery school within a year or less or 2) at least enough to cover your monthly payment, if not double or triple with one doula client per month if that is something you’re interested in doing alongside your IBMS learning. I don’t mean to make it sound overly simple but it also doesn’t have to be difficult! If you feel like you want a step by step doula and birth birth support, our Birth Warrior Project is another place you could start. Once you are bringing in income that way, midwifery school might feel like less of a stretch.

And my final recommendation when thinking about the money that it costs to become a midwife, whether through our training, another training or just the cost of apprenticeship is to remember that at the end of this, you will be able to generate your OWN income, doing something you love. If you pay the higher end of our enrollment fee at $9000, it would only take 3 clients before making a return on your investment. There are very few soul fulfilling, world changing, community generating, low cost start up opportunities like midwifery, so if it is calling to you, I encourage you to dive in more by taking our Beginner’s Guide to Radical Midwifery mini-course, or watch this free webinar on Becoming the Radical Midwife Your Community Needs.

+ show Comments

- Hide Comments

add a comment