We have done a variety of payment plan options over the years and if we have learned one thing it is that people who ask for payment plans, especially ones that extend beyond the time in our program, are often also the people who already have one foot out the door, and are afraid to commit. Not having the money, in these cases, is a manifestation of their lack of commitment. Of course this is not always the case! But over 1/2 of the people that we have extended payment plans to have bailed on their commitment as soon as things got hard either with the coursework, life, or their finances.

This puts us in a super awkward position of being lowest priority. It disrupts the flows of our school and is totally demoralizing when we are putting effort and resources into our students with the goal of them finishing and becoming successful midwives in the world.

Paying in full, up front, is a major commitment and it is a way of having skin in the game so that when life gets hard, as it inevitably does, you can recall that you made the commitment to keep going anyways. Do I think we should always push ourselves to continue when things get hard? No, not necessarily. But I do know that it is very easy to come up with excuses about why you need to take a break.

A payment plan makes it much easier psychologically to bail, even if you sign a contract saying you agree to continue paying until the payment is completed. People have approached our payment plans like they are renting our materials for the month, and can just decide to stop next month. It feels real bad.

So let me pose two other options if you are someone who genuinely feels like they need a payment plan.

1. You pay yourself (into an envelope or savings account) the same amount you were going to pay IBMS every month, and when you have the amount in full, you can enroll! This requires self control, discipline, and long term thinking.

The only benefit to what most people think about when they think of a payment plan is that you can start before you have all the money, which is awesome when you are genuinely someone who is in a hard place financially and want to jump into learning so that you can get yourself out of that financial pickle faster. That is why people invented student loans, credit cards, etc.

2. If you are one of these people who KNOWS you are going to be a midwife, and you just need the training to get there, putting a midwifery course on a credit card or personal loan makes perfect sense.

Here’s some math.

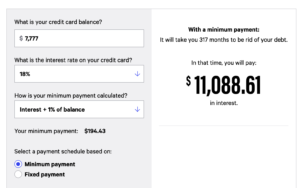

Our program is $7777. If you put every penny of that on a shitty 18% APR credit card, and pay only the minimum balance, here is what you’re looking at. A total cost of $18,865 and 26 years to pay it off if you never pay more than that minimum. You can play around with this same credit calculator here. Not great right, but also still a total steal if you are going to become a midwife, do what you love, and make even $50,000 a year (a starting goal that a lot of our students have shared with us) which is a very attainable goal.

Now let’s say that you make those minimum payments for the 4-5 years you are learning and getting your business set up, and then you put half of each client’s fee towards the credit card that first year. After 55 months of minimum payments you would owe $4474.50.

![]()

You have one client a month as you’re getting started, let’s say, and you’re charging them $4000. You would have the balance paid off within the first few months of being a midwife. Pretty sweet right? Sometimes people need a perspective shift and some clear hard numbers to really weigh out the benefits of an investment. I hear a lot of “I don’t use credit cards” or “I abstain from debt” but I think that when you understand what you are signing up for and have a way to turn that debt into a thriving business, it is worth reconsidering those rigid ideas.

Whatever the case, if you are someone who is dreaming of attending the Indie Birth Midwifery School, and money is the barrier, please consider these ideas, and take some time to assess your level of commitment and then make a plan to start saving for school or getting credit/a long. We have two built it “payment plans” for the school including paying with PayPal (creates a new line of credit) or using SplitIt which utilizes an existing line of credit (that has at least $7777 available on it) but breaks up the payments over up to 12 months. And if you are like “I’m allergic to money and I have a credit score of 0” and you want to change that, you can check out the work I do under a different hat as a financial coach here.

+ show Comments

- Hide Comments

add a comment